HMRC will often get in touch with you via email. But this means scammers can take advantage of the situation – especially if they are promising a refund!

A client recently received a real email from HMRC. It spurred us on to let you know how you can spot the difference between real and fake HMRC emails.

They had received the email as they had filed their self-assessment tax return on time.

As many people are receiving similar emails at the moment, we thought we’d share some advice.

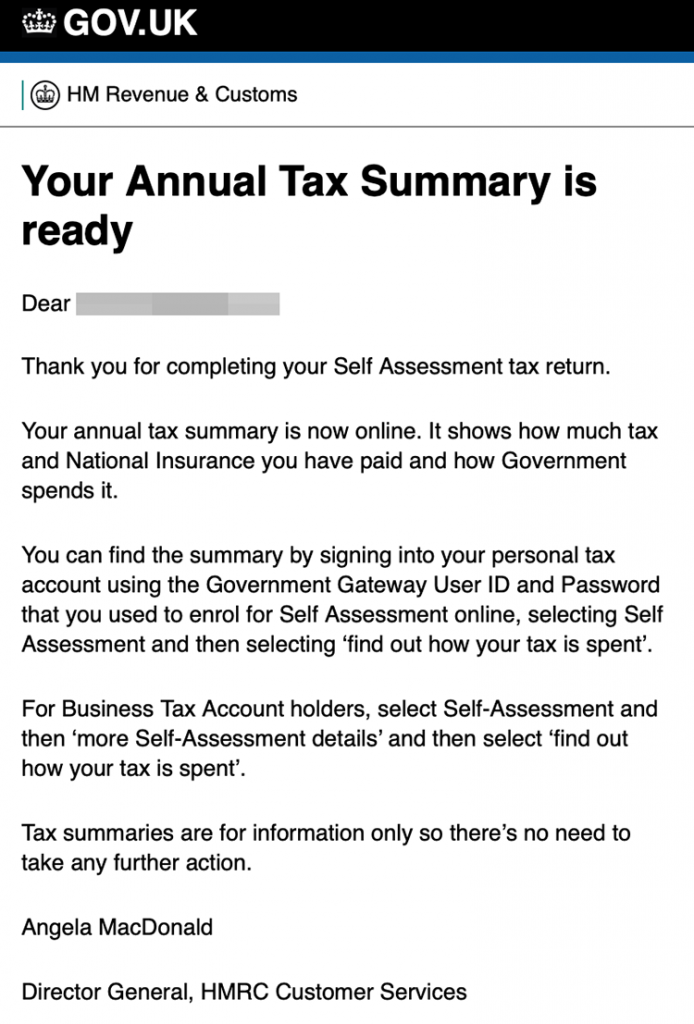

The real email

Above is a screenshot of a real email from HMRC and it’s easy to see spot the difference once shown.

First of all, there are no requests to click on a link to the HMRC website. It sounds obvious but that is the giveaway!

If you receive an email asking you to ‘click here’ then it will be a scam. That is because HMRC never asks you to click anywhere.

Even if you are owed a refund, they will never ask you to click and give your details to them.

It is exciting thinking have a refund, but HMRC won’t contact you via email to tell you.

Instead, they inform you by letter. And they never ask for bank details as they will send the refund to your bank account or by cheque.

Try to avoid clicking on the links just in case you download a virus. But even if you do, just make sure you leave the website as soon as possible.

They will not attach any documents either as this could be a way of infecting your computer. If there is one it will be a fake email.

And remember, HMRC does not send an email asking you to share debit or credit card details or bank information.

Other ways of contact

If you have underpaid your tax, HMRC may give you a call. Beyond that, they will not.

So, if you receive a phone call demanding payment and your bank or card details, it’s a fake.

A real employee may call but it will be to discuss your account. The moment a request is made for your details, that’s the time to put the phone down.

Some scammers use an automated voice that tells you they are filing a lawsuit against you. Again, put the phone down if you receive a call like this.

Other ways scammers will try to get your information is by:

- Text. HRMC never uses texts to contact you

- WhatsApp: You won’t be contacted using the App.

Speak to your accountant

HMRC will understand if you are ever suspicious of a call. If you are, the best way is to put down the phone. You can email any concerns to [email protected]

You can also speak to your accountant. Usually, your accountant will know of any issues before you. But if not, then they can contact HMRC on your behalf a lot more easily than you can.

If the underpayment or overpayment is an issue they will find out for you.

HMRC has more information on its website. Or you can always contact Concept Accountancy. We are accountants based in Newcastle, but we are happy to help business owners keep peace of mind.